Essay

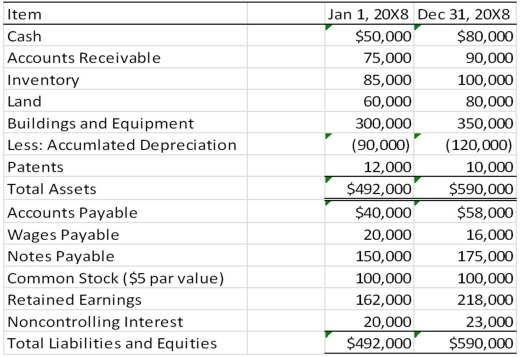

Locus Corporation acquired 80 percent ownership of Stereo Company on January 1, 20X6, at underlying book value. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Stereo Company. Consolidated balance sheets at January 1, 20X8, and December 31, 20X8, are as follows:

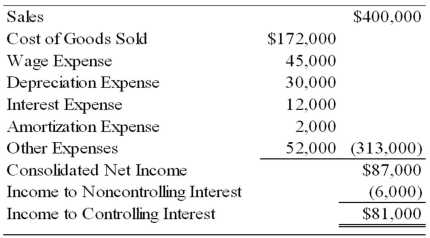

The consolidated income statement for 20X8 contained the following amounts:

Locus and Stereo paid dividends of $25,000 and $15,000, respectively, in 20X8.

Required:

1) Prepare a worksheet to develop a consolidated statement of cash flows for 20X8 using the indirect method of computing cash flows from operations.

2) Prepare a consolidated statement of cash flows for 20X8.

Correct Answer:

Verified

1)  2) Consolidated ...

2) Consolidated ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Sigma Company develops and markets organic food

Q3: Company A owns 85 percent of Company

Q4: New Life Corporation has just finished preparing

Q5: Tower Corporation's controller has just finished preparing

Q6: Tower Corporation's controller has just finished preparing

Q8: Locus Corporation acquired 80 percent ownership of

Q9: Company A owns 85 percent of Company

Q10: Catalyst Corporation acquired 90 percent of Trigger

Q11: Jupiter Corporation's consolidated cash flow statement for

Q12: Denver Corporation owns 25 percent of the