Multiple Choice

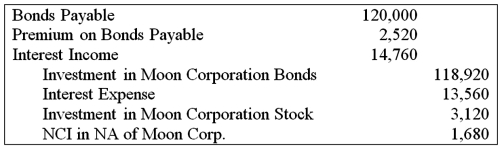

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1, 20X3, which Star Corporation purchased. On July 1, 20X7, Sun Corporation purchased $120,000 face value of Moon bonds from Star. The bonds pay 12 percent interest annually on December 31. The preparation of consolidated financial statements for Moon and Sun at December 31, 20X9, required the following eliminating entry:  Based on the information given above, if 20X9 consolidated net income of $50,000 would have been reported without the eliminating entry provided, what amount will actually be reported?

Based on the information given above, if 20X9 consolidated net income of $50,000 would have been reported without the eliminating entry provided, what amount will actually be reported?

A) $47,900

B) $48,200

C) $49,400

D) $48,800

Correct Answer:

Verified

Correct Answer:

Verified

Q6: ABC, a holder of a $400,000 XYZ

Q7: Master Corporation owns 85 percent of Servant

Q9: Moon Corporation issued $300,000 par value 10-year

Q10: Granite Company issued $200,000 of 10 percent

Q12: Moon Corporation issued $300,000 par value 10-year

Q14: Master Corporation owns 85 percent of Servant

Q15: On January 1, 20X7, Gild Company acquired

Q16: Light Corporation owns 80 percent of Sound

Q37: At the end of the year,a parent

Q40: Culver owns 80 percent of the common