Multiple Choice

ABC Corporation purchased land on January 1, 20X6, for $50,000. On July 15, 20X8, it sold the land to its subsidiary, XYZ Corporation, for $70,000. ABC owns 80 percent of XYZ's voting shares.

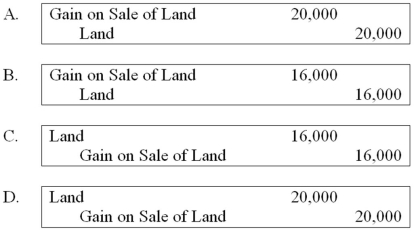

Based on the preceding information, what will be the worksheet eliminating entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X8?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Mortar Corporation acquired 80 percent of Granite

Q6: Mortar Corporation acquired 80 percent of Granite

Q7: ABC Corporation purchased land on January 1,

Q9: Blue Corporation holds 70 percent of Black

Q10: Peter Architectural Services owns 100 percent of

Q11: Mortar Corporation acquired 80 percent of Granite

Q12: Big Company acquired 75 percent of Little

Q13: Sky Corporation owns 75 percent of Earth

Q14: Blue Corporation holds 70 percent of Black

Q15: Mortar Corporation acquired 80 percent of Granite