Multiple Choice

-What is the effect on tax revenue if the government increases the excise tax on a product that has an elastic demand?

A) It will rise.

B) It will fall.

C) It may rise or fall depending on whether the tax is a flat rate or a percentage of the price of the product.

D) It is totally unpredictable.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: Suppose that average incomes decreased from $38,000

Q55: Below are some data on price,income and

Q56: What is the likely effect of the

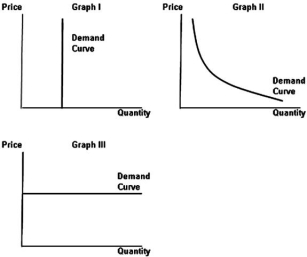

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5692/.jpg" alt=" -How will the

Q58: Define 'elasticity coefficient'

Q60: What is income elasticity?<br>A)The change in the

Q61: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5692/.jpg" alt=" -Refer to the

Q62: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5692/.jpg" alt=" -Refer to the

Q63: All of the following statements except one

Q64: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5692/.jpg" alt=" -If a product