Multiple Choice

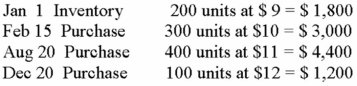

Moss Co. uses the FIFO method to calculate ending inventory. Assuming 300 units are not sold, the cost of goods sold is:

A) $7,600

B) $7,280

C) $3,120

D) $3,400

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Bauer Supply had total cost of goods

Q14: The specific identification method is able to

Q43: Crestwood Paint Supply had a beginning inventory

Q47: Given the following:<br> LIFO method 250 units

Q48: With Department A sales of $200,000, Department

Q48: A company can change from LIFO to

Q53: During inflation, the best method to use

Q55: Overhead expenses are:<br>A)Directly related to a specific

Q63: LIFO doesn't always match the physical flow

Q64: The weighted-average method is best used:<br>A)For heterogeneous