Multiple Choice

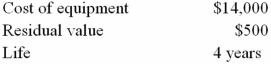

What is the depreciation expense for the second year (straight-line method) using the following?

A) $14,500

B) $13,500

C) $3,375

D) $3,275

E) None of these

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: A truck costs $35,000 with a residual

Q11: Copyrights will depreciate.

Q27: ACRS came before MACRS.

Q28: Residual value is not used in calculating

Q34: A depreciation schedule for partial years must

Q51: Book value is cost plus accumulated depreciation.

Q56: Book value is:<br>A)Cost plus accumulated depreciation<br>B)Cost minus

Q60: The units-of-production method is based on the

Q61: All assets that last longer than one

Q84: Cost recovery using MACRS is calculated by:<br>A)Rate