Multiple Choice

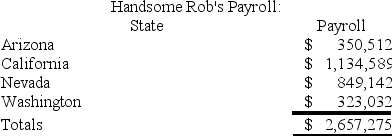

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

A) $934,589

B) $1,134,589

C) $1,215,347

D) $2,657,275

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Public Law 86-272 protects a taxpayer from

Q50: Several states are now moving from a

Q58: The payroll factor includes payments to independent

Q76: Wyoming imposes an income tax on corporations.

Q78: Which of the following activities will create

Q110: Roxy operates a dress shop in Arlington,

Q114: Use tax liability accrues in the state

Q115: Super Sadie, Incorporated, manufactures sandals and distributes

Q118: Giving samples and promotional materials without charge

Q132: Most states have shifted away from an