Essay

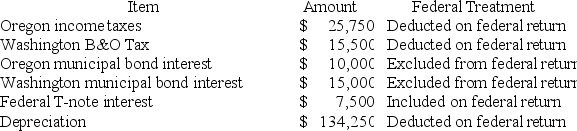

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,500. Moss's federal taxable income was $549,743. Calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,500. Moss's federal taxable income was $549,743. Calculate Moss's Oregon state tax base.

Correct Answer:

Verified

$571,743.

$549,743 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$549,743 +...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The state tax base is computed by

Q27: What was the Supreme Court's holding in

Q28: State tax law is comprised solely of

Q84: Mighty Manny, Incorporated, manufactures ice scrapers and

Q85: Bethesda Corporation is unprotected from income tax

Q87: Mighty Manny, Incorporated, manufactures ice scrapers and

Q91: Which of the following is an income-based

Q103: Nondomiciliary businesses are subject to tax everywhere

Q104: A state's apportionment formula divides nonbusiness income

Q117: The Wrigley case held that the sale