Essay

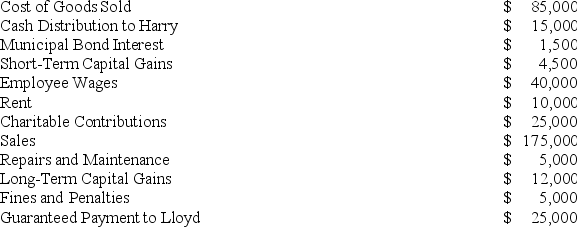

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Adjustments to a partner's outside basis are

Q13: Tim, a real estate investor, Ken, a

Q14: Sarah, Sue, and AS Inc.formed a partnership

Q28: Guaranteed payments are included in the calculation

Q36: Under proposed regulations issued by the Treasury

Q47: What form does a partnership use when

Q53: In what order should the tests to

Q67: A partner can generally apply passive activity

Q95: Jordan, Inc., Bird, Inc., Ewing, Inc., and

Q125: Kim received a one-third profits and capital