Essay

Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

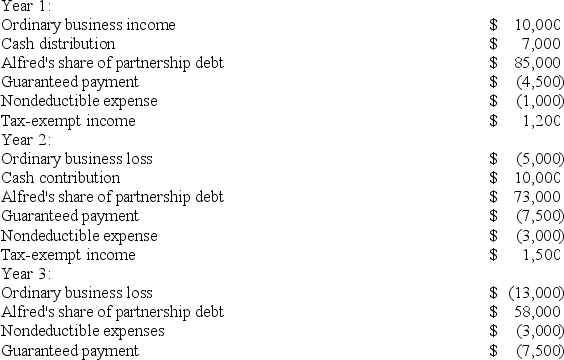

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Correct Answer:

Verified

At the end of Year 2, Alfred's basis is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Bob is a general partner in Fresh

Q6: Which of the following statements exemplifies the

Q9: A partner's tax basis or at-risk amount

Q23: The main difference between a partner's tax

Q40: Partnership tax rules incorporate both the entity

Q46: For partnership tax years ending after December

Q91: Which of the following does not adjust

Q94: An additional allocation of partnership debt or

Q114: Partners must generally treat the value of

Q123: Which person would generally be treated as