Essay

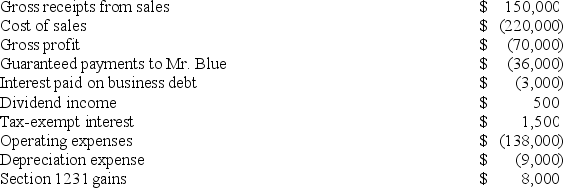

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G General Partnership. Their partnership agreement states that they will each receive a 50 percent profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

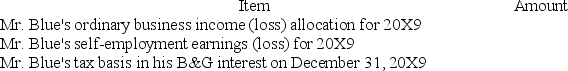

Complete the following table related to Mr. Blue's interest in B&G partnership:

Correct Answer:

Verified

See table below:

Tax basis = Initial c...

Tax basis = Initial c...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: If partnership debt is reduced and a

Q12: Clint noticed that the Schedule K-1 he

Q60: Nonrecourse debt is generally allocated according to

Q62: For partnership tax years ending after December

Q68: If a taxpayer sells a passive activity

Q83: Under general circumstances, debt is allocated from

Q85: TQK, LLC, provides consulting services and was

Q93: Which of the following would not be

Q98: How does additional debt or relief of

Q127: A partnership can elect to amortize organization