Essay

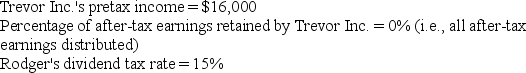

Rodger owns 100 percent of the shares in Trevor Inc., a C corporation. Assume the following for the current year:

Given these assumptions, how much cash does Rodger have from the dividend after all taxes have been paid?

Given these assumptions, how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Sole proprietorships are not treated as legal

Q15: S corporation shareholders are legally responsible for

Q20: Sole proprietors are subject to self-employment taxes

Q26: Business income allocations to owners from an

Q35: Which of the following statements is true

Q38: Which of the following statements is true

Q63: Which of the following legal entities are

Q69: A single-member LLC is taxed as a

Q79: If an individual forms a sole proprietorship,

Q84: An unincorporated entity with more than one