Multiple Choice

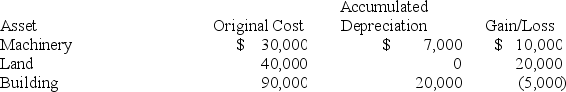

Brandon, an individual, began business four years ago and has sold §1231 assets with $5,000 of losses within the last five years. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Use dividends and capital gains tax rates for reference.

A) $25,000 ordinary income and $8,000 tax liability.

B) $25,000 §1231 gain and $3,750 tax liability.

C) $13,000 §1231 gain, $12,000 ordinary income, and $5,790 tax liability.

D) $12,000 §1231 gain, $13,000 ordinary income, and $5,960 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A net §1231 gain becomes ordinary while

Q14: Losses on sales between related parties are

Q28: The sale of computer equipment used in

Q37: Which one of the following is not

Q42: Peroni Corporation sold a parcel of land

Q51: Which of the following is not true

Q62: Frederique sold furniture that she uses in

Q73: For a like-kind exchange, realized gain is

Q111: Redoubt LLC exchanged an office building used

Q118: Which of the following transactions results solely