Essay

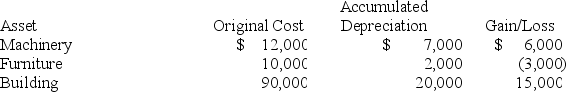

Suzanne, an individual, began business four years ago and has never sold a §1231 asset. Suzanne owned each of the assets for several years. In the current year, Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Correct Answer:

Verified

$6,000 ordinary gain, $12,000 unrecaptur...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Depreciation recapture changes both the amount and

Q40: A deferred like-kind exchange does not help

Q52: Which of the following realized gains results

Q55: Butte sold a machine to a machine

Q63: Odintz traded land for land. Odintz originally

Q66: Tyson had a parcel of undeveloped investment

Q69: An asset's tax-adjusted basis is usually greater

Q90: Andrea sold a piece of machinery she

Q93: A parcel of land is always a

Q122: Assets held for investment and personal use