Multiple Choice

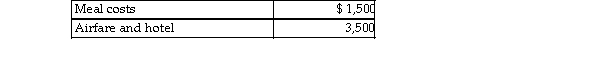

Steven is a representative for a textbook publishing company. Steven attends a convention which will also be att by many potential customers. During the week of the convention, Steven incurs the following costs in attending conference and taking potential customers to lunch and dinner to discuss book sales.  Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

Having recently been to a company seminar on tax laws, Steven makes sure that business is discussed at the various meals. Steven is reimbursed $2,000 by his employer under an accountable plan. Steven's AGI for 2018 is $50,000, and he does itemize deductions. For tax purposes, how will Steven treat the $2,000 partial reimbursement and the $2,500 of unreimbursed expenses?

A) Reimbursement- include in income; unreimbursed expenses- deduct within itemized deductions, after 50% reduction for meal portion

B) Reimbursement- include in income; unreimbursed expenses- no deduction allowed

C) Reimbursement- exclude from income; unreimbursed expenses- deduct within itemized deductions, after 50% reduction for meal portion

D) Reimbursement- exclude from income; unreimbursed expenses- no deduction allowed

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Because a partnership is a pass-through entity

Q1077: A Technical Advice Memorandum is usually<br>A) part

Q1078: Indicate for each of the following the

Q1079: AB Partnership earns $500,000 in the current

Q1080: All of the following statements are true

Q1081: Ten years ago Finn Corporation formed a

Q1083: Tom and Heidi, husband and wife, file

Q1085: Jack purchases land which he plans on

Q1086: If an individual with a taxable income

Q1087: Leigh inherited $65,000 of City of New