Multiple Choice

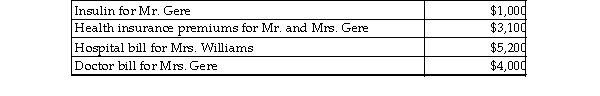

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000 in 2018. During the tax ye they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's c claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of t deductible itemized medical expenses?

Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of t deductible itemized medical expenses?

A) $13,300

B) $8,300

C) $9,550

D) $5,200

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Refundable tax credits are allowed to reduce

Q15: Gross income may be realized when a

Q55: A taxpayer may elect to defer recognition

Q1551: Indicate with a "yes" or a "no"

Q1552: What are some factors which indicate that

Q1553: Frank and Marion, husband and wife, file

Q1557: Alan, who is a security officer, is

Q1558: WAM Corporation sold a warehouse during the

Q1560: Emily made the following interest free loans

Q1561: The filing status in which the rates