Multiple Choice

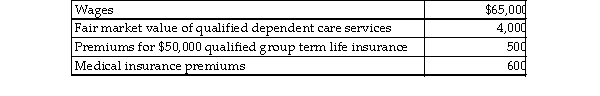

Carl filed his tax return, properly claiming the head of household filing status. Carl's employer paid or provided following to Carl:  How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis) ?

A) $70,100

B) $65,000

C) $69,000

D) $69,500

Correct Answer:

Verified

Correct Answer:

Verified

Q37: Two separate business operations conducted at the

Q49: Expenditures for long-term care insurance premiums qualify

Q1719: What is the purpose of Sec. 1245

Q1720: In April 2018, Amelia exchanges a commercial

Q1721: During the current year, Danika recognizes a

Q1722: During the course of an audit, a

Q1723: Jill is considering making a donation to

Q1726: Medical expenses incurred on behalf of children

Q1728: In computing AMTI, tax preference items are<br>A)

Q1729: A client wants to take a tax