Essay

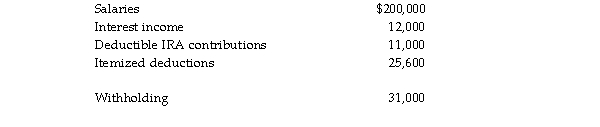

The following information is available for Bob and Brenda Horton, a married couple filing a joint return, for 2018 Bob and Brenda are age 32 and have no dependents.  a. What is the amount of their gross income?

a. What is the amount of their gross income?

b. What is the amount of their adjusted gross income?

c. What is the amount of their taxable income?

d. What is the amount of their tax liability (gross tax), rounded to the nearest dollar?

e. What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A $10,000 gain earned on stock held

Q74: An LLC that elects to be taxed

Q2221: Yusef, age 15, is a dependent of

Q2222: A taxpayer at risk for AMT should

Q2223: For non- cash charitable donations, an appraisal

Q2224: Which of the following documents is issued

Q2225: Mitzi's 2018 medical expenses include the following:

Q2227: Form 6251, Alternative Minimum Tax, must be

Q2228: Determine the net deductible casualty loss on

Q2229: John, who is President and CEO of