Multiple Choice

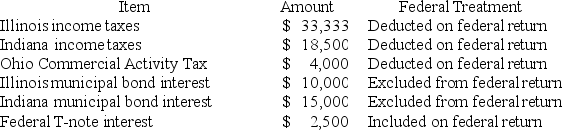

PWD Incorporated is an Illinois corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $100,000.Calculate PWD's Illinois state tax base.

PWD's federal taxable income was $100,000.Calculate PWD's Illinois state tax base.

A) $116,000

B) $130,833

C) $131,000

D) $164,333

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Federal/state adjustments correct for differences between two

Q74: Hoosier Incorporated is an Indiana corporation.It properly

Q83: What was the Supreme Court's holding in

Q84: Lefty provides demolition services in several southern

Q85: Bethesda Corporation is unprotected from income tax

Q91: Tennis Pro, a Virginia corporation domiciled in

Q104: A state's apportionment formula divides nonbusiness income

Q115: Businesses subject to income tax in more

Q121: Which of the following is incorrect regarding

Q137: Which of the following is not a