Essay

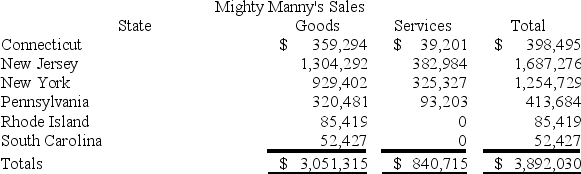

Mighty Manny,Incorporated,manufactures and services deli machinery and distributes it across the United States.Mighty Manny is incorporated and headquartered in New Jersey.It has sales tax nexus in Connecticut,New Jersey,New York,Pennsylvania,Rhode Island,and South Carolina.Mighty Manny has sales as follows:

Assume the following sales tax rates: Connecticut (6.75 percent),New Jersey (7.5 percent),New York (8.5 percent),Pennsylvania (6.5 percent),Rhode Island (7.25 percent),and South Carolina (5.5 percent).Assume that Connecticut also taxes Mighty Manny's services.What is Mighty Manny's total sales and use tax liability?

Assume the following sales tax rates: Connecticut (6.75 percent),New Jersey (7.5 percent),New York (8.5 percent),Pennsylvania (6.5 percent),Rhode Island (7.25 percent),and South Carolina (5.5 percent).Assume that Connecticut also taxes Mighty Manny's services.What is Mighty Manny's total sales and use tax liability?

Correct Answer:

Verified

$233,626.($398,495 × 6.75 perc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The state tax base is computed by

Q8: On which of the following transactions should

Q37: Public Law 86-272 protects a taxpayer from

Q48: Super Sadie,Incorporated,manufactures sandals and distributes them across

Q86: Failure by a seller to collect and

Q101: Businesses must pay income tax in their

Q105: In recent years, states are weighting the

Q110: Roxy operates a dress shop in Arlington,

Q117: The Wrigley case held that the sale

Q134: All states employ some combination of sales