Essay

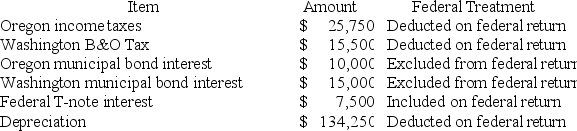

Moss Incorporated is a Washington corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,500.Moss's federal taxable income was $549,743.Calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,500.Moss's federal taxable income was $549,743.Calculate Moss's Oregon state tax base.

Correct Answer:

Verified

$571,743.$549,743 + ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Tennis Pro is headquartered in Virginia. Assume

Q23: Gordon operates the Tennis Pro Shop in

Q24: Big Company and Little Company are both

Q29: Commercial domicile is the location where a

Q29: Gordon operates the Tennis Pro Shop in

Q58: The payroll factor includes payments to independent

Q74: Gordon operates the Tennis Pro Shop in

Q87: Mighty Manny, Incorporated, manufactures ice scrapers and

Q116: The annual value of rented property is

Q132: Most states have shifted away from an