Essay

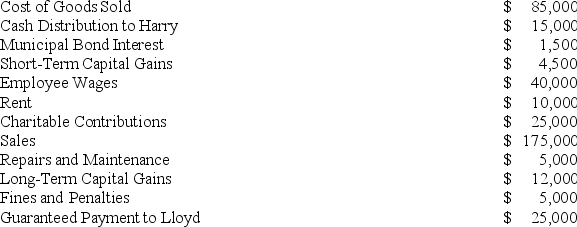

Lloyd and Harry,equal partners,form the Ant World Partnership.During the year,Ant World had the following revenue,expenses,gains,losses,and distributions:

Given these items,what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Given these items,what amount of ordinary business income (loss)and what separately stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Adjustments to a partner's outside basis are

Q69: Which of the following statements is true

Q84: On June 12, 20X9, Kevin, Chris, and

Q85: A partner's self-employment earnings (loss)may be affected

Q91: Which of the following does not adjust

Q103: Which of the following items is subject

Q113: Any losses that exceed the tax basis

Q122: On March 15, 20X9, Troy, Peter, and

Q124: Sue and Andrew form SA general partnership.

Q131: Explain why partners must increase their tax