Essay

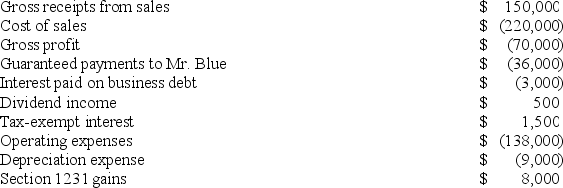

On January 1,20X9,Mr.Blue and Mr.Grey each contributed $100,000 to form the B&G General Partnership.Their partnership agreement states that they will each receive a 50 percent profits and loss interest.The partnership agreement also provides that Mr.Blue will receive an annual $36,000 guaranteed payment.B&G began business on January 1,20X9.For its first taxable year,its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30,20X9.B&G repaid $10,000 of the loan on December 15,20X9.Neither of the partners received a cash distribution from B&G in 20X9.

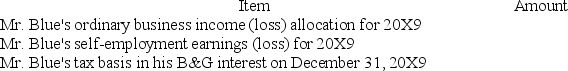

Complete the following table related to Mr.Blue's interest in B&G partnership:

Correct Answer:

Verified

See table below:  Tax basis = Initial co...

Tax basis = Initial co...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Jay has a tax basis of $14,000

Q30: On January 1, X9, Gerald received his

Q39: Partnerships may maintain their capital accounts according

Q42: How does a partnership make a tax

Q44: This year, Reggie's distributive share from Almonte

Q86: This year, HPLC, LLC, was formed by

Q88: Partnerships can use special allocations to shift

Q93: Which of the following would not be

Q98: How does additional debt or relief of

Q112: Tax elections are rarely made at the