Multiple Choice

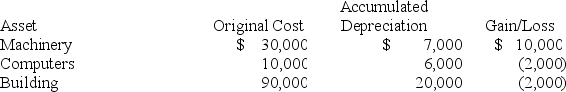

Brandon,an individual,began business four years ago and has never sold a §1231 asset.Brandon owned each of the assets for several years.In the current year,Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent,what effect do the gains and losses have on Brandon's tax liability?

A) $7,000 ordinary income,$1,000 §1231 loss,and $1,920 tax liability.

B) $6,000 ordinary income and $1,920 tax liability.

C) $7,000 §1231 gain and $2,240 tax liability.

D) $7,000 §1231 gain and $1,050 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: All tax gains and losses are ultimately

Q60: Winchester LLC sold the following business assets

Q72: Only accelerated depreciation is recaptured for §1245

Q79: Andrew,an individual,began business four years ago and

Q80: Suzanne,an individual,began business four years ago and

Q94: Bozeman sold equipment that it uses in

Q99: Kristi had a business building destroyed in

Q104: For an installment sale, the gross profit

Q109: After application of the look-back rule, net

Q119: Residential real property is not like-kind with