Essay

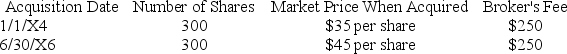

On December 1,20X7,George Jimenez needed a little extra cash for the upcoming holiday season,and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction.Prior to the sale,George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase).(Do not round intermediate calculations.)

If his goal is to minimize his current capital gain,how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain,how much capital gain will George report from the sale?

Correct Answer:

Verified

Using the specific identification method...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: Losses associated with personal-use assets, sales to

Q41: The capital gains (losses)netting process for taxpayers

Q49: Which of the following is not a

Q52: Generally,interest income is taxed at preferential capital

Q58: Which of the following types of interest

Q61: Bob Brain files a single tax return

Q64: Investment interest expense is a for AGI

Q65: On the sale of a passive activity,

Q79: One primary difference between corporate and U.S.

Q89: What is the correct order of the