Essay

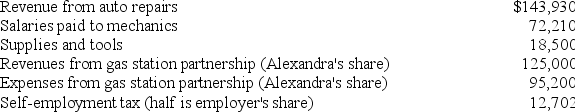

Alexandra operates a garage as a sole proprietorship.Alexandra also owns a half interest in a partnership that operates a gas station.This year Alexandra paid or reported the following expenses related to her garage and other property.Determine Alexandra's AGI for 2019.

Correct Answer:

Verified

$76,669 All of the expenses ar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Jon and Holly are married and live

Q23: Misti purchased a residence this year.Misti,age 32,is

Q26: The phrase "ordinary and necessary" means that

Q32: Which of the following is a true

Q40: This year Amanda paid $749 in federal

Q50: Which of the following is a true

Q59: Which of the following costs are deductible

Q84: Unreimbursed employee business expenses and hobby expenses

Q102: Rental or royalty expenses are deductible "for"

Q112: Taxpayers are allowed to deduct mortgage interest