Essay

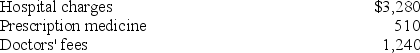

Erika (age 62)was hospitalized with injuries from an auto accident this year.She incurred the following expenses from the accident:

In addition,Erika's auto was completely destroyed in the accident.She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident.What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

In addition,Erika's auto was completely destroyed in the accident.She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident.What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

Correct Answer:

Verified

$1,030 of medical expenses.The...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: This year Kelly bought a new auto

Q7: Self-employed taxpayers can deduct the cost of

Q25: The deduction for medical expenses is limited

Q26: The phrase "ordinary and necessary" means that

Q32: Campbell, a single taxpayer, has $400,000 of

Q84: Unreimbursed employee business expenses and hobby expenses

Q100: Last year Henry borrowed $15,000 to help

Q102: Rental or royalty expenses are deductible "for"

Q112: Taxpayers are allowed to deduct mortgage interest

Q113: This fall Millie finally repaid her student