Multiple Choice

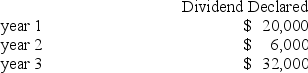

Fargo Company's outstanding stock consists of 400 shares of noncumulative 5% preferred stock with a $10 par value and 3,000 shares of common stock with a $1 par value.During the first three years of operation,the corporation declared and paid the following total cash dividends.  The amount of dividends paid to preferred and common shareholders in year 1 is:

The amount of dividends paid to preferred and common shareholders in year 1 is:

A) $200 preferred; $19,800 common.

B) $4,000 preferred; $16,000 common.

C) $17,000 preferred; $3,000 common.

D) $10,000 preferred; $10,000 common.

E) $20,000 preferred; $0 common.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Percy Corporation was formed on January 1.The

Q62: Purchasing treasury stock reduces the corporation's assets

Q64: A company has 50,000 shares of common

Q66: Prior to September 30,a company has never

Q67: The following data were reported by a

Q68: Mayan Company had net income of $132,000.The

Q69: A company's stock is selling for $35.70

Q73: The stockholders' equity section of a corporation's

Q97: Purchasing treasury stock reduces the corporation's assets

Q158: Stocks that pay relatively large cash dividends