Multiple Choice

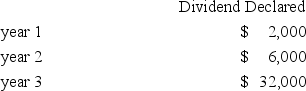

Sweet Company's outstanding stock consists of 1,000 shares of cumulative 5% preferred stock with a $100 par value and 10,000 shares of common stock with a $10 par value.During the first three years of operation,the corporation declared and paid the following total cash dividends.  The amount of dividends paid to preferred and common shareholders in year 3 is:

The amount of dividends paid to preferred and common shareholders in year 3 is:

A) $7,000 preferred; $25,000 common.

B) $5,000 preferred; $27,000 common.

C) $15,000 preferred; $17,000 common.

D) $32,000 preferred; $0 common.

E) $0 preferred; $32,000 common.

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Dividend yield is the percent of cash

Q76: Record the following transactions of Naches Corporation

Q106: A preemptive right means shareholders can purchase

Q107: A corporation sold 14,000 shares of its

Q122: Global Corporation had 50,000 shares of $20

Q122: If a corporation receives assets other than

Q128: The following data has been collected about

Q129: A corporation issued 5,000 shares of its

Q170: The main limitation in using book value

Q197: The price at which a share of