Multiple Choice

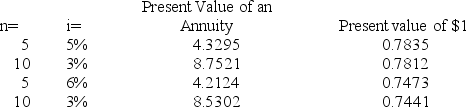

Sharmer Company issues 5%,5-year bonds with a par value of $1,000,000 and semiannual interest payments.On the issue date,the annual market rate for these bonds is 6%.What is the bond's issue (selling) price,assuming the following factors:

A) $957,355

B) $1,000,000

C) $1,250,000

D) $786,745

E) $1,213,255

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The debt-to-equity ratio enables financial statement users

Q22: The issue price of bonds is found

Q58: Operating leases are long-term or noncancelable leases

Q85: A discount reduces the interest expense of

Q94: The present value of an annuity is

Q98: When the contract rate of a bond

Q132: The effective interest method assigns a bond

Q159: On April 1, a company issues 6%,

Q192: On January 1, Year 1 a company

Q229: The carrying (book) value of a bond