Multiple Choice

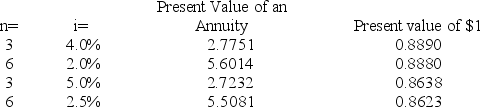

On January 1,a company issues bonds dated January 1 with a par value of $200,000.The bonds mature in 3 years.The contract rate is 4%,and interest is paid semiannually on June 30 and December 31.The market rate is 5%.Using the present value factors below,the issue (selling) price of the bonds is:

A) $205,607.

B) $194,492.

C) $200,000.

D) $22,032.

E) $172,460.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: A lease is a contractual agreement between

Q45: Sinking fund bonds reduce the bondholder's risk

Q77: A company has assets of $350,000 and

Q81: When a bond sells at a premium:<br>A)

Q111: _ bonds are bonds that are scheduled

Q124: Promissory notes that require the issuer to

Q138: Premium on Bonds Payable is an adjunct

Q143: On January 1,a company issued and sold

Q158: Amortizing a bond discount:<br>A) Allocates a portion

Q196: The market value (issue price) of a