Essay

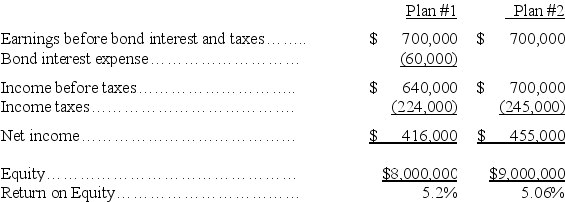

A corporation plans to invest $1 million in oil exploration.The corporation is considering two plans to raise the money.Under Plan #1,bonds with a contract rate of interest of 6% would be issued.Under Plan #2,50,000 additional shares of common stock would be issued at $20 per share.The corporation currently has 300,000 shares of stock outstanding,and it expects to earn $700,000 per year before bond interest and income taxes.The net income and return on investment for both plans is shown below:

Comment on the relative effects of each alternative,including when one form of financing is preferred to another.

Comment on the relative effects of each alternative,including when one form of financing is preferred to another.

Correct Answer:

Verified

Plan #1 provides a slightly higher retur...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: A bond is issued at par value

Q40: The contract between the bond issuer and

Q72: Sinking fund bonds:<br>A)Require the issuer to set

Q101: On January 1,a company issued and sold

Q102: On January 1,Year 1,Stratton Company borrowed $100,000

Q108: On January 1,Haymark Corporation leased a truck,agreeing

Q111: All of the following statements regarding accounting

Q142: How are bond issue prices determined?

Q174: A particular feature of callable bonds is

Q222: On January 1, Year 1 Cleaver Company