Essay

A company issued 10%,10-year bonds with a par value of $1,000,000 on January 1,at a selling price of $885,295 when the annual market interest rate was 12%.The company uses the effective interest amortization method.Interest is paid semiannually each June 30 and December 31.

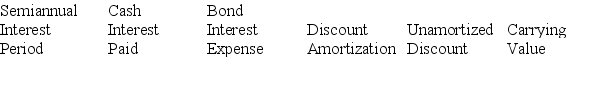

(1)Prepare an amortization table for the first two payment periods using the format shown below:

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

(1)  6/30/: Cash payment: $1,000,000 * 1...

6/30/: Cash payment: $1,000,000 * 1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: A bond with a par value of

Q22: A lessee has substantially all of the

Q37: The contract rate on previously issued bonds

Q75: The equal total payments pattern for installment

Q107: An advantage of lease financing is the

Q110: Identify the advantages and disadvantages of bond

Q141: Describe installment notes and the nature of

Q160: An _ is an obligation requiring a

Q207: The debt-to-equity ratio is calculated by dividing

Q227: Return on equity increases when the expected