Essay

A company issued 10%,5-year bonds with a par value of $2,000,000,on January 1.Interest is to be paid semiannually each June 30 and December 31.The bonds were sold at $2,162,290 based on an annual market rate of 8%.The company uses the effective interest method of amortization.

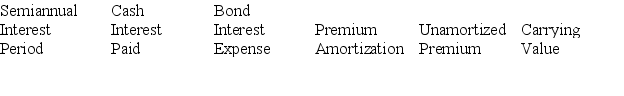

(1)Prepare an amortization table for the first two semiannual payment periods using the format shown below.

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

(1)  6/30 Cash payment: $2,000,000 * 10%...

6/30 Cash payment: $2,000,000 * 10%...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Mortgage contracts grant the lender the right

Q28: On January 1, a company issued 10%,

Q62: The rate of interest that borrowers are

Q80: The relationship between the market rate of

Q172: When applying equal total payments to a

Q190: The carrying (book) value of a bond

Q195: Convertible bonds can be exchanged for a

Q196: A company issued 10-year,7% bonds with a

Q197: On January 1,a company issues bonds dated

Q206: The factor for the present value of