Essay

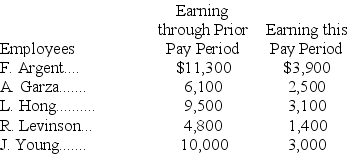

A company's employees had the following earnings records at the close of the current payroll period:

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $127,200 of earnings plus 1.45% FICA Medicare on all wages; 0.6% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

The company's payroll taxes expense on each employee's earnings includes: FICA Social Security taxes of 6.2% on the first $127,200 of earnings plus 1.45% FICA Medicare on all wages; 0.6% federal unemployment taxes on the first $7,000; and 2.5% state unemployment taxes on the first $7,000.Compute the employer's total payroll taxes expense for the current pay period.

Correct Answer:

Verified

1 Employee pay subject to unemp...

1 Employee pay subject to unemp...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: A liability is a probable future payment

Q62: The state unemployment tax rates applied to

Q78: A company estimates that warranty expense will

Q88: On April 12,Hong Company agrees to accept

Q140: Employers' responsibilities for payroll do not include:<br>A)Providing

Q164: Accounting for contingent liabilities depends on the

Q165: An employee earned $4,600 in February working

Q167: Trey Morgan is an employee who is

Q181: Uncertainties from the development of new competing

Q205: FUTA requires employers to pay a federal