Essay

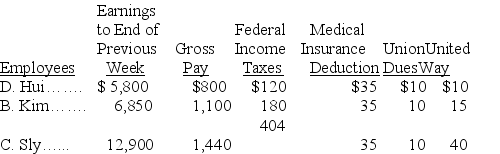

The payroll records of a company provided the following data for the current weekly pay period ended March 12.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: All of the following statements regarding liabilities

Q15: Explain how to calculate times interest earned

Q82: The correct times interest earned computation is:<br>A)(Net

Q88: Trey Morgan is an employee who is

Q90: An employee earned $138,500 working for an

Q91: On November 1,Alan Company signed a 120-day,8%

Q97: A company has advance subscription sales totaling

Q128: All of the following statements regarding long-term

Q140: On November 1, Casey's Snowboards signed a

Q162: Banks authorized to accept deposits of amounts