Essay

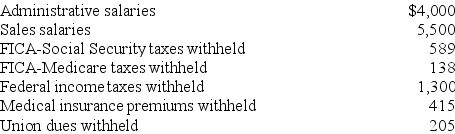

A company's payroll information for the month of May follows:

On May 31 the company issued Check No.4625 payable to the Payroll Bank Account to pay for the May payroll.It issued payroll checks to the employees after depositing the check.

On May 31 the company issued Check No.4625 payable to the Payroll Bank Account to pay for the May payroll.It issued payroll checks to the employees after depositing the check.

(1)Prepare the journal entry to record (accrue)the employer's payroll for May.(2)Prepare the journal entry to record payment of the May payroll.The federal and state unemployment tax rates are 0.6% and 5.4%,respectively,on the first $7,000 paid to each employee.The wages and salaries subject to these taxes were $6,000.(3)Prepare the journal entry to record the employer's payroll taxes.

Correct Answer:

Verified

*$6,000 *...

*$6,000 *...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Athena Company provides employee health insurance that

Q12: Gross pay less all deductions is called

Q30: Debt guarantees are:<br>A)Never disclosed in the financial

Q34: If a company has advance subscription sales

Q124: Contingent liabilities must be recorded if:<br>A)The future

Q146: All of the following statements regarding FICA

Q175: During June,Vixen Company sells $850,000 in merchandise

Q180: An employee earns $5,500 per month working

Q182: A company's employer payroll tax rates are

Q200: A known obligation of an uncertain amount