Essay

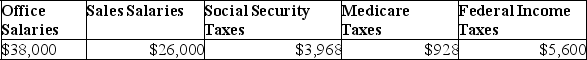

Deacon Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.

a.Recorded the May payroll using the payroll register information given above.

a.Recorded the May payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the May payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is 0.6%.

c.Issued a check to Reliant Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Reliant Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,020.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Springfield Company offers a bonus plan to

Q24: _ are amounts owed to suppliers for

Q61: Obligations to be paid within one year

Q86: A company sells sofas with a 6-month

Q136: A payroll register does not include:<br>A)Pay period

Q138: If a company has advance ticket sales

Q140: A company sold $12,000 worth of bicycles

Q145: On December 1,Victoria Company signed a 90-day,6%

Q165: The amount of FICA tax that employers

Q176: The times interest earned ratio reflects:<br>A) A