Multiple Choice

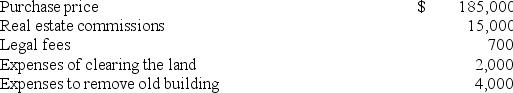

Merchant Company purchased property for a building site.The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $187,700 to Land; $19,000 to Building.

B) $200,700 to Land; $6,000 to Building.

C) $200,000 to Land; $6,700 to Building.

D) $185,000 to Land; $21,700 to Building.

E) $206,700 to Land; $0 to Building.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A company purchased a weaving machine for

Q36: Gaston owns equipment that cost $90,500 with

Q38: Depreciation expense is higher in earlier years

Q41: The term,obsolescence,as it relates to the useful

Q51: A company purchased equipment valued at $66,000.It

Q93: What are some of the variables that

Q99: When the usefulness of plant assets used

Q109: Financial accounting and tax accounting require the

Q157: The straight-line depreciation method and the double-declining-balance

Q224: Explain the impact, if any, on depreciation