Essay

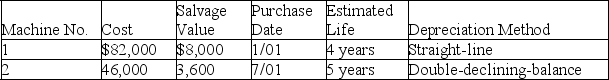

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Machine 1:

Year 1________ Year 2 ________

Machine 2:

Year 1 ________ Year 2 ________

Correct Answer:

Verified

Machine 1: Years 1 & 2: [($82,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q69: Fields Company purchased equipment on January 1

Q72: On April 1,Year 1,Raines Co.purchased and placed

Q74: The process of allocating the cost of

Q75: When originally purchased,a vehicle costing $23,000 had

Q77: On January 2,2010,a company purchased a delivery

Q79: Explain how to calculate total asset turnover.

Q147: A company purchased a weaving machine for

Q182: A new machine costing $1,800,000 cash and

Q214: It is necessary to report both the

Q228: Depletion is the process of allocating the