Essay

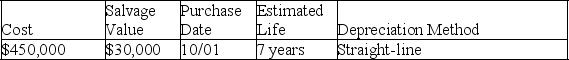

A company's property records revealed the following information about one of its plant assets:

Calculate the depreciation expense for the asset in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for the asset in Year 1 and Year 2 for the year ended December 31.

Year 1________ Year 2 ________

Correct Answer:

Verified

Year 1 [($450,000 − ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Phoenix Agency leases office space for $7,000

Q69: A company purchased and installed equipment on

Q85: A benefit of using an accelerated depreciation

Q116: Total depreciation expense over an asset's useful

Q130: A company purchased property for $100,000.The property

Q153: A company purchased a delivery van for

Q220: Total asset cost plus depreciation expense equals

Q236: When an asset is purchased (or disposed

Q245: Allyn Company purchased equipment costing $55,000 on

Q246: The Oberon Company purchased a delivery truck