Multiple Choice

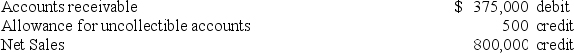

A company uses the percent of receivables method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit.Based on past experience,the company estimates that 6% of receivables are uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit.Based on past experience,the company estimates that 6% of receivables are uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

A) $22,500

B) $23,000

C) $22,000

D) $4,800

E) $5,500

Correct Answer:

Verified

Correct Answer:

Verified

Q20: A promissory note is a written promise

Q58: The process of using accounts receivable as

Q98: All of the following statements regarding valuation

Q116: A company factored $45,000 of its accounts

Q125: Companies use two methods to account for

Q136: When posting a dishonored note to a

Q148: The aging method of determining bad debts

Q181: The realizable value refers to the expected

Q207: Duerr company makes a $60,000,60-day,12% cash loan

Q212: A company uses the percent of sales