Multiple Choice

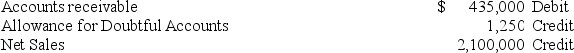

The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense reports the following selected amounts:  All sales are made on credit.Based on past experience,the company estimates 3.5% of ending account receivable to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 3.5% of ending account receivable to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $13,975; credit Allowance for Doubtful Accounts $13,975.

B) Debit Bad Debts Expense $15,225; credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $16,475; credit Allowance for Doubtful Accounts $16,475.

D) Debit Bad Debts Expense $7,350; credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $17,350; credit Allowance for Doubtful Accounts $17,350.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: A credit sale of $5,275 to a

Q25: The percent of sales method for estimating

Q32: The _ method of computing uncollectible accounts

Q54: A company receives a 10%,120-day note for

Q58: Jervis sells $75,000 of its accounts receivable

Q60: The interest accrued on $7,500 at 6%

Q61: Valley Spa purchased $7,800 in plumbing components

Q64: The balance in Accounts Receivable,the control account,must

Q73: Frederick Company borrows $63,000 from First City

Q140: The person who signs a note receivable