Multiple Choice

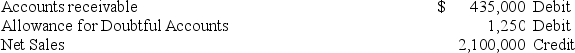

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense.  All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $19,750; credit Allowance for Doubtful Accounts $19,750.

B) Debit Bad Debts Expense $15,225; credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $22,250; credit Allowance for Doubtful Accounts $22,250.

D) Debit Bad Debts Expense $7,350; credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $21,000; credit Allowance for Doubtful Accounts $21,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The account receivable turnover measures:<br>A)How long it

Q27: Uniform Supply accepted a $4,800,90-day,10% note from

Q54: A supplementary record created to maintain a

Q106: A high accounts receivable turnover in comparison

Q122: A company has $80,000 in outstanding accounts

Q135: A company borrowed $10,000 by signing a

Q137: After adjustment, the balance in the Allowance

Q141: Jax Recording Studio purchased $7,800 in electronic

Q171: The advantage of the allowance method of

Q210: If a customer owes interest on accounts