Essay

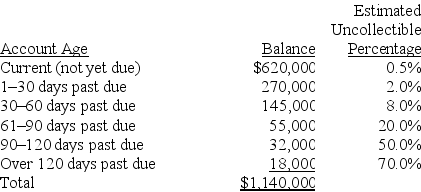

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

Required:

a.Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement,assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $41,000 and that accounts receivable written off during the current year totaled $43,200.

c.Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d.Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The Tulip Company uses the percent of

Q15: On December 31,of the current year,Spectrum Company's

Q23: A note that the maker is unable

Q39: Explain how to record the receipt (acceptance)

Q65: The accounts receivable turnover is calculated by

Q83: Converting receivables to cash before they are

Q83: Sellers allow customers to use credit cards

Q130: The allowance method of accounting for bad

Q152: What are some of the considerations management

Q177: A company factored $30,000 of its accounts