Essay

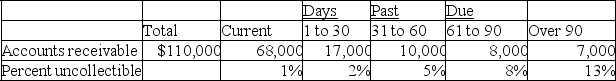

Bonita Company estimates uncollectible accounts using the allowance method at December 31.It prepared the following aging of receivables analysis.

a.Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

a.Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

b.Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a.Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $550 credit.

c.Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a.Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $300 debit.

Correct Answer:

Verified

$3,070 −...

$3,070 −...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Orman Co. sold $80,000 of accounts receivable

Q36: On February 1,a customer's account balance of

Q64: Owens Company uses the direct write-off method

Q113: The following series of transactions occurred during

Q162: A company received a $15,000, 90-day, 10%

Q165: Flax had net sales of $7,875 and

Q168: On July 9,Mifflin Company receives an $8,500,90-day,8%

Q172: A company had the following items and

Q178: The Links Company uses the percent of

Q203: At December 31 of the current year,