Multiple Choice

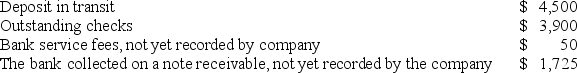

Franklin Company deposits all cash receipts on the day they are received and makes all cash payments by check.At the close of business on August 31,its Cash account shows a debit balance of $13,162.Franklin's August bank statement shows $14,237 on deposit in the bank.Determine the adjusted cash balance using the following information:  The adjusted cash balance should be:

The adjusted cash balance should be:

A) $18,737

B) $10,337

C) $14,887

D) $13,112

E) $14,837

Correct Answer:

Verified

Correct Answer:

Verified

Q5: The entry to establish a petty cash

Q8: A key factor in a voucher system

Q29: Plenty Co. established a petty cash fund

Q44: A sales system with prenumbered, controlled sales

Q72: Signature cards, deposit tickets, checks, and bank

Q83: The internal document prepared by a department

Q181: A company's internal control system:<br>A) Eliminates the

Q183: Meng Co.maintains a $300 petty cash fund.On

Q194: Two limitations of internal control systems are

Q195: Cash equivalents are short-term highly liquid investment