Essay

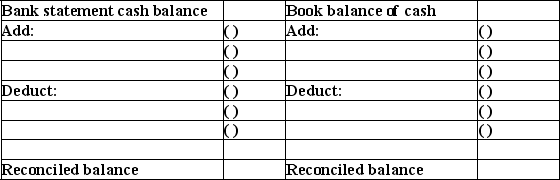

Following are seven items a through g that would cause Rembrandt Company's book balance of cash to differ from its bank statement balance of cash.

a.A service charge imposed by the bank.

b.A check listed as outstanding on the previous period's reconciliation and still outstanding at the end of this month.

c.A customer's check returned by the bank is marked "Not Sufficient Funds (NSF)".

d.A deposit mailed to the bank on the last day of the current month and not recorded on this month's bank statement.

e.A check paid by the bank at its correct $190 amount recorded in error in the company's check register at $109.

f.An unrecorded credit memorandum indicating that bank collected a note receivable for Rembrandt Company and deposited the proceeds in the company's account.

g.A check written in the current period that is not yet paid or returned by the bank.

Indicate where each item,letters a-g,would appear on Rembrandt Company's bank reconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Umber Company's bank reconciliation for September is

Q26: A properly designed internal control system:<br>A) Lowers

Q50: The clerk who has access to the

Q65: An internal control system consists of the

Q95: A bank statement provided by the bank

Q114: Liquidity refers to a company's ability to

Q147: The use of internal controls provides a

Q158: _ are checks written by the depositor,

Q212: Outstanding checks, deposits in transit, deductions for

Q215: Discuss how the principles of internal control