Essay

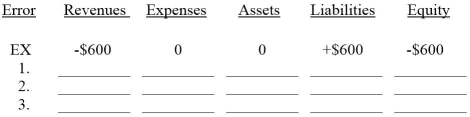

Given the table below,indicate the impact of the following errors made during the adjusting entry process.Use a "+" followed by the amount for overstatements,a "-" followed by the amount for understatements,and a "0" for no effect.The first one is done as an example.

Ex.Failed to recognize that $600 of unearned revenues,previously recorded as liabilities,had been earned by year-end.

1.Failed to accrue interest expense of $200.

2.Forgot to record $7,700 of depreciation on machinery.

3.Failed to accrue $1,300 of revenue earned but not collected.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The main purpose of adjusting entries is

Q42: A salary owed to employees is an

Q74: On a work sheet, if the Debit

Q96: A company performs 20 days of work

Q128: A benefit of using a work sheet

Q171: In preparing statements from the adjusted trial

Q314: If accrued salaries were recorded on December

Q316: Based on the following information from Scranton

Q317: Accumulated Depreciation and Service Fees Earned would

Q319: If the Balance Sheet and Statement of