Essay

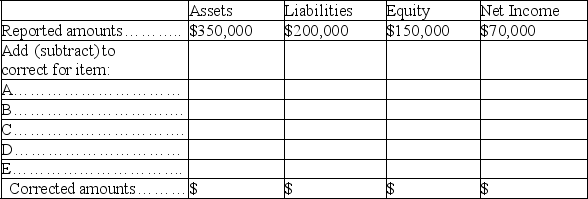

A company issued financial statements for the year ended December 31,but failed to include the following adjusting entries:

A.Accrued interest revenue earned of $1,200.

B.Depreciation expense of $4,000.

C.Portion of prepaid insurance expired (an asset)used $1,100.

D.Accrued taxes of $3,200.

E.Revenues of $5,200,originally recorded as unearned,have been earned by the end of the year.

Determine the correct amounts for the December 31 financial statements by completing the following table:

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Describe the two alternate methods used to

Q69: The aim of a post-closing trial balance

Q78: If all columns of a completed work

Q84: On September 1,Kennedy Company loaned $100,000,at 12%

Q85: Holman Company owns equipment with an original

Q87: On April 1,Garcia Publishing Company received $1,548

Q90: Truman had total assets of $149,501,000,net income

Q92: On January 1,Eastern College received $1,200,000 from

Q117: What is the proper adjusting entry at

Q121: Prepare general journal entries on December 31